So what’s all the fuss about Cooperative Coffees raising its minimum price to US$2.20 on all fair trade and organic coffees??

If we get caught-up in price-boasting matches within the Specialty Coffee industry, a guaranteed US$2.20 /lb minimum price may not sound sufficiently impressive. But if we look at how market mechanisms, pricing and fluctuation translate in terms of risk for farmers and their organizations – our story becomes more dramatic.

As someone who paid for university with tips from waiting tables… I remember the anxiety of never knowing whether or not my monthly income would be able to cover my monthly expenses. And my belly still hurts when I think about how that financial unpredictability had me eating left-over-salad-dressing sandwiches for several semesters!

Now take that financial anxiety and multiply it a thousand-fold. When we visit a producer partner and learn of their plans for multi-million dollar investments in order to keep their infrastructure up to task for the demands for ever-increasing quality, I wonder if I would have the nerve to take on that kind of long-term risk. Without knowing the contract price for the following harvest, nor for every harvest down the road until the credit has been recovered, is like financial Russian Roulette.

Now take that financial anxiety and multiply it a thousand-fold. When we visit a producer partner and learn of their plans for multi-million dollar investments in order to keep their infrastructure up to task for the demands for ever-increasing quality, I wonder if I would have the nerve to take on that kind of long-term risk. Without knowing the contract price for the following harvest, nor for every harvest down the road until the credit has been recovered, is like financial Russian Roulette.

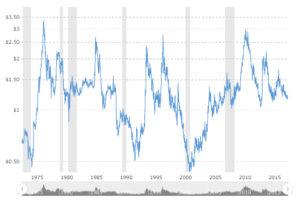

If coffee were a product that was paid for in accordance with the work that goes into its production, this would be a completely different story. But since the base-price for coffee is determined by a violently fluctuating commodities market, a farmer’s profits or losses from the sale of his or her coffee remain an enormous gamble.

Supply and demand does influence price fluctuations locally and internationally. If a major producer country like Brazil is poised to show a bumper crop – price on the C-market will drop. OR if drought, flooding, frost, leaf-rust or any other illness or pest linked to our increasingly extreme weather patterns wipe out a local or regional harvest – prices will likely rise as producer organizations and exporters scramble to gather enough product to fill their contracts. But the fluctuations driven by the invisible forces of external investment portfolios and speculation — even in times of stable production – make for an even more unpredictable impact on prices. And as we see from an historical coffee price perspective – the only thing we can be sure of is that it’s impossible to predict forward what will happen!

Especially since the financial crisis of 2008, coffee and other agricultural futures contracts have become more attractive to investment-portfolio managers. Today, the sheer volumes of coffee futures contracts being traded in one direction can cause price stagnation or increasingly violent price fluctuation — beyond what “normal” market forces would have otherwise created.

Especially since the financial crisis of 2008, coffee and other agricultural futures contracts have become more attractive to investment-portfolio managers. Today, the sheer volumes of coffee futures contracts being traded in one direction can cause price stagnation or increasingly violent price fluctuation — beyond what “normal” market forces would have otherwise created.

As a result, these “mysterious mechanisms” of a distant C-market have only become increasingly decoupled from the day-to-day realities and the needs of the majority of some 25 million farmers and workers around the world, who depend on coffee for their economic survival. And from a farmer’s perspective, the direction things are headed is not very encouraging.

From an industry as powerful and influential as Specialty Coffee, we can do better to create pricing mechanisms that correspond with the effort and the up-front resources farmers invest to produce a high-quality product, and to help stabilize the income for farmers and their collective organizations. We ask a lot from farmers in terms of quality, information, access and reliability. And yet, our industry still bases coffee price-setting upon a commodity mechanism that’s largely irrelevant to the product we actually trade.

From an industry as powerful and influential as Specialty Coffee, we can do better to create pricing mechanisms that correspond with the effort and the up-front resources farmers invest to produce a high-quality product, and to help stabilize the income for farmers and their collective organizations. We ask a lot from farmers in terms of quality, information, access and reliability. And yet, our industry still bases coffee price-setting upon a commodity mechanism that’s largely irrelevant to the product we actually trade.

In establishing a new floor price – at US$2.20/lb on all our fair trade and organic coffees, Coop Coffees’ producer partners know that regardless of what happens in the NY “C” market, at least they can calculate well into the future the minimum income they can expect from our contracts. Of course, in addition to the minimum-price guarantee, our partners are also free and encouraged to negotiate the quality and context premiums — in keeping with the local market dynamics of the moment – they deem necessary to compete for the best coffees their farmer members can produce.

We’ve set high quality standards with our producer partners. And as a fair-and-direct, coffee-importing cooperative, we’ve come to appreciate the irrevocable value their export track-record represents to our roaster members. So offering this minimum price guarantee to our partners as an “additional buffer” to international trade risk, is a no-brainer. And we hope that pushing the price upwards becomes an increasingly popular trend!

“A guaranteed increase of 20 cents on the minimum price is significant when you look at how the international market has been behaving in the past year,” says COMSA General Manager Rodolfo Peñalba. “This is great news for COMSA and for each one of our members; and without a doubt we are grateful to Coop Coffees for this gesture. Finding commercial partners of the caliber of Coop Coffees is not easy; in the list of coffee roasters and importers in the world there are few like them.”

“A guaranteed increase of 20 cents on the minimum price is significant when you look at how the international market has been behaving in the past year,” says COMSA General Manager Rodolfo Peñalba. “This is great news for COMSA and for each one of our members; and without a doubt we are grateful to Coop Coffees for this gesture. Finding commercial partners of the caliber of Coop Coffees is not easy; in the list of coffee roasters and importers in the world there are few like them.”

And from a Coop Coffees perspective, we would say that finding the caliber of producer partners, such as the line-up we’ve been able to recruit and maintain, is equally challenging. We fully acknowledge the effort, care and diligence our partners bring to the cultivation, processing and export of the coffee we depend upon. And that’s just one more reason – why we and other responsible traders should remain vigilant, conscious and concerned that everyone along the supply chain is getting his and her fair share of the benefits!

Author: Monika Firl

May 30, 2018